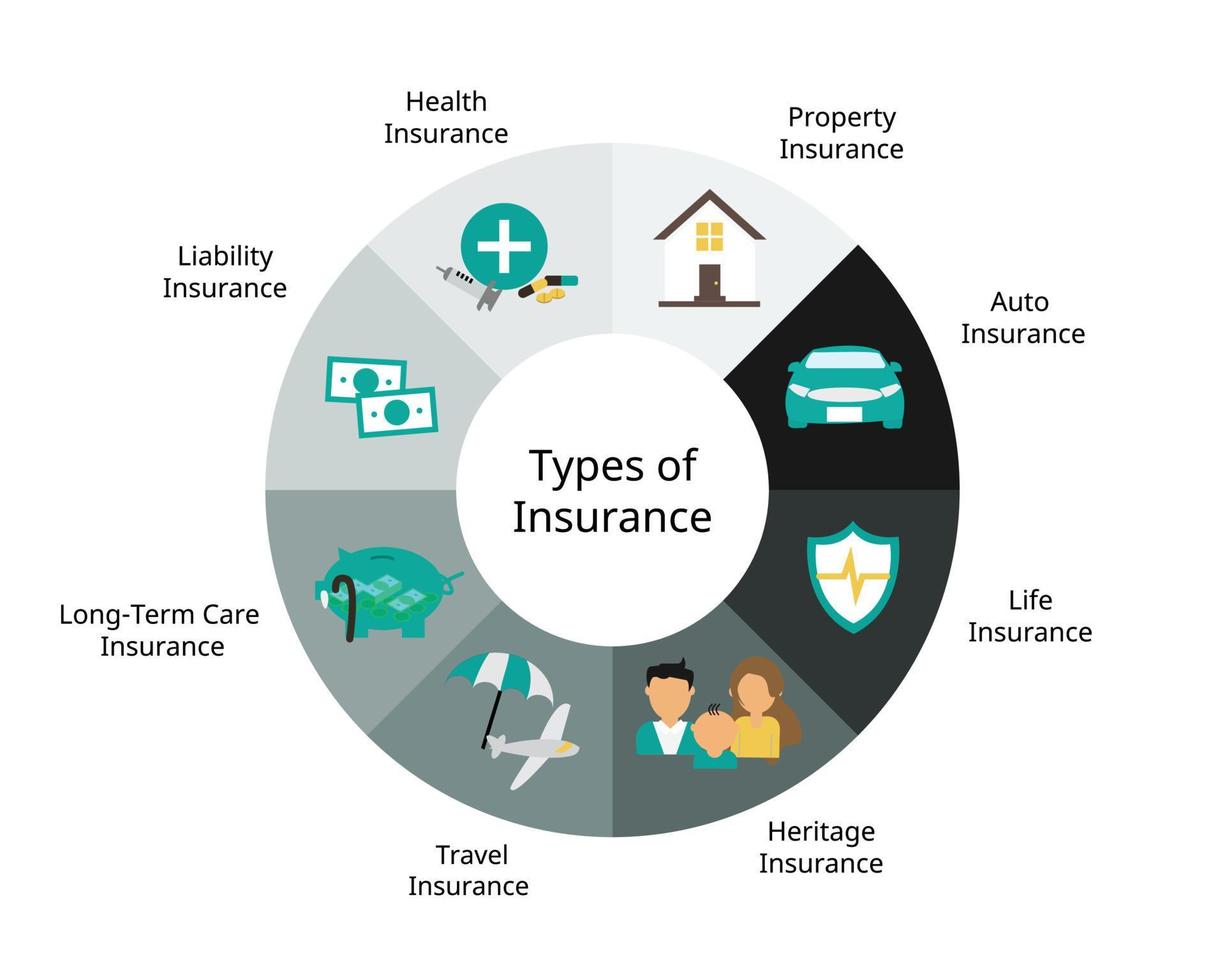

Insurance is an essential aspect of managing risk and protecting your financial well-being. With so many different types of insurance available, it can be overwhelming to figure out which ones you really need. The type of insurance you require depends on several factors, including your lifestyle, financial situation, family status, and assets. Here’s a guide to help you understand the various types of insurance and determine which ones are crucial for your needs:

Health Insurance

Health insurance is perhaps the most crucial type of insurance you’ll need, as medical expenses can quickly become overwhelming without it. Whether it’s routine check-ups, unexpected surgeries, or emergency care, health insurance helps cover these expenses. It covers doctor visits, hospital stays, prescription drugs, and preventive services. It helps protect against unexpected medical expenses. Health insurance is essential to protect against unexpected medical costs. Even if you’re young and healthy, it’s wise to have coverage in case of an emergency.

Life Insurance

Life insurance provides financial protection for your loved ones in the event of your death. It can help cover funeral costs, pay off debts, and ensure your family’s financial security. There are two main types: term life insurance (for a specific period) and whole life insurance (providing coverage for your entire life and with a savings component). Beneficiaries can use the payout to maintain their lifestyle, cover educational expenses, or pay off debts. If you have dependents, a mortgage, or significant debts, life insurance is necessary to ensure your family is financially supported after your death. If you’re single or don’t have any dependents, you may not need it.

Auto Insurance

Auto insurance is required by law in most places, and it’s designed to protect you financially if you’re in a car accident. It covers damages to your vehicle, medical costs, and liability for injuries to others. There are different types, such as liability insurance (covers the cost of damage to other vehicles and property), collision insurance (covers damage to your own vehicle from accidents), and comprehensive insurance (covers theft, vandalism, natural disasters, and other non-collision-related damage). If you own or lease a car, auto insurance is usually a legal requirement. Even if you own an old or less valuable vehicle, having basic liability coverage is still important to protect yourself financially.

Homeowners or Renters Insurance

Homeowners insurance protects your home and belongings from damage or loss due to events like fires, theft, or natural disasters. Renters insurance provides similar protection for your personal property if you rent a home or apartment. Homeowners insurance covers your home’s structure, personal property, and liability in case someone gets injured on your property. Renters insurance covers your personal belongings and provides liability coverage, but it doesn’t cover the building or the landlord’s property. If you own a home, homeowners insurance is typically required by lenders and is essential to protect your property and possessions. If you rent, renters insurance is highly recommended to cover the cost of replacing personal property in the event of theft, fire, or other disasters.

Disability Insurance

Disability insurance provides income replacement if you are unable to work due to illness or injury. This can help ensure that you can maintain your standard of living while you recover. There are two types: short-term disability (typically covers a few months) and long-term disability (covers longer periods, often years, and may last until you can return to work or reach retirement age). If you depend on your income to support yourself and your family, disability insurance is an important safety net in case you suffer an illness or injury that prevents you from working.

Long-Term Care Insurance

Long-term care insurance helps pay for services you may need as you age, such as nursing home care, assisted living, or home health care. It is designed for individuals who may need extended care due to a chronic illness or disability. It covers the cost of extended care services that aren’t typically covered by regular health insurance. Helps protect your assets and ensures you have access to the care you need without depleting your savings. If you’re planning for the future and concerned about the potential costs of long-term care, especially as you age, long-term care insurance can provide peace of mind. It is typically more affordable the younger you are when you purchase it.

Umbrella Insurance

Umbrella insurance provides additional liability coverage beyond the limits of your other insurance policies, such as auto or homeowners insurance. It’s useful for protecting your assets in case you’re sued for an accident or incident that exceeds the limits of your existing policies. It offers additional protection if you face a large lawsuit, for example, if you’re involved in a serious car accident or if someone gets injured on your property. It typically covers incidents that may not be covered by other policies, such as slander, defamation, or false arrest. If you have significant assets, a high-net-worth individual, or simply want extra protection against large lawsuits, umbrella insurance can offer peace of mind and help safeguard your financial future.

Travel Insurance

Travel insurance helps protect against losses while traveling, such as trip cancellations, medical emergencies, lost luggage, or other travel-related mishaps. It can cover trip cancellations, medical emergencies, flight delays, and lost or stolen belongings. Important for international travelers, as it can help cover medical emergencies abroad and other unexpected events. If you’re traveling internationally or have a non-refundable trip booked, travel insurance can be a smart investment to protect your financial investment and health while abroad.

Pet Insurance

Pet insurance helps cover veterinary costs for your pets. This can include regular checkups, emergency medical treatments, surgeries, and prescription medications. It helps offset the high cost of veterinary care, especially in emergencies or for chronic conditions. Offers different levels of coverage, from accident-only to comprehensive plans that include wellness care. If you have a pet, especially one that could be prone to health issues or is aging, pet insurance can provide financial relief in case of unexpected medical bills.

Identity Theft Insurance

Identity theft insurance helps you recover if your identity is stolen. This can include covering legal fees, lost wages, and the cost of restoring your credit. It helps with the costs of identity theft recovery, such as legal expenses and fraud investigation. Often includes identity monitoring services to alert you to potential fraudulent activity. If you’re concerned about the risk of identity theft, particularly in a world where data breaches are more common, identity theft insurance can provide protection and help you restore your identity if it’s stolen.

Conclusion: What Insurance Do You Need?

The types of insurance you need will depend on your unique circumstances, lifestyle, and financial goals. In general, everyone should have health insurance, auto insurance (if you own a car), and homeowners or renters insurance. Beyond that, consider other policies based on your financial situation, family status, and potential risks. For example, life insurance is crucial if you have dependents, disability insurance if you rely on your income, and umbrella insurance if you have substantial assets. Each type of insurance serves a different purpose, so it’s important to assess your needs carefully. Consulting with an insurance agent can help you tailor the right combination of coverage for your personal situation, ensuring you have the protection you need without overpaying.Attach